ARIMA(0,1,0) : 4762.801

ARIMA(0,1,0) with drift : 4761.123

ARIMA(0,1,0)(0,0,1)[12] : 4751.105

ARIMA(0,1,0)(0,0,1)[12] with drift : 4750.212

ARIMA(0,1,0)(0,0,2)[12] : 4749.802

ARIMA(0,1,0)(0,0,2)[12] with drift : 4749.14

ARIMA(0,1,0)(1,0,0)[12] : 4748.883

ARIMA(0,1,0)(1,0,0)[12] with drift : 4748.184

ARIMA(0,1,0)(1,0,1)[12] : Inf

ARIMA(0,1,0)(1,0,1)[12] with drift : Inf

ARIMA(0,1,0)(1,0,2)[12] : Inf

ARIMA(0,1,0)(1,0,2)[12] with drift : Inf

ARIMA(0,1,0)(2,0,0)[12] : 4742.386

ARIMA(0,1,0)(2,0,0)[12] with drift : 4742.203

ARIMA(0,1,0)(2,0,1)[12] : Inf

ARIMA(0,1,0)(2,0,1)[12] with drift : Inf

ARIMA(0,1,0)(2,0,2)[12] : Inf

ARIMA(0,1,0)(2,0,2)[12] with drift : Inf

ARIMA(0,1,1) : 4581.902

ARIMA(0,1,1) with drift : 4581.821

ARIMA(0,1,1)(0,0,1)[12] : 4577.654

ARIMA(0,1,1)(0,0,1)[12] with drift : 4577.884

ARIMA(0,1,1)(0,0,2)[12] : 4573.756

ARIMA(0,1,1)(0,0,2)[12] with drift : 4574.212

ARIMA(0,1,1)(1,0,0)[12] : 4576.446

ARIMA(0,1,1)(1,0,0)[12] with drift : 4576.758

ARIMA(0,1,1)(1,0,1)[12] : Inf

ARIMA(0,1,1)(1,0,1)[12] with drift : Inf

ARIMA(0,1,1)(1,0,2)[12] : Inf

ARIMA(0,1,1)(1,0,2)[12] with drift : Inf

ARIMA(0,1,1)(2,0,0)[12] : 4568.379

ARIMA(0,1,1)(2,0,0)[12] with drift : 4569.08

ARIMA(0,1,1)(2,0,1)[12] : Inf

ARIMA(0,1,1)(2,0,1)[12] with drift : Inf

ARIMA(0,1,1)(2,0,2)[12] : Inf

ARIMA(0,1,1)(2,0,2)[12] with drift : Inf

ARIMA(0,1,2) : 4578.515

ARIMA(0,1,2) with drift : 4578.734

ARIMA(0,1,2)(0,0,1)[12] : 4575.644

ARIMA(0,1,2)(0,0,1)[12] with drift : 4576.08

ARIMA(0,1,2)(0,0,2)[12] : 4572.671

ARIMA(0,1,2)(0,0,2)[12] with drift : 4573.279

ARIMA(0,1,2)(1,0,0)[12] : 4574.772

ARIMA(0,1,2)(1,0,0)[12] with drift : 4575.261

ARIMA(0,1,2)(1,0,1)[12] : Inf

ARIMA(0,1,2)(1,0,1)[12] with drift : Inf

ARIMA(0,1,2)(1,0,2)[12] : Inf

ARIMA(0,1,2)(1,0,2)[12] with drift : Inf

ARIMA(0,1,2)(2,0,0)[12] : 4568.289

ARIMA(0,1,2)(2,0,0)[12] with drift : 4569.079

ARIMA(0,1,2)(2,0,1)[12] : Inf

ARIMA(0,1,2)(2,0,1)[12] with drift : Inf

ARIMA(0,1,3) : 4579.677

ARIMA(0,1,3) with drift : 4580.023

ARIMA(0,1,3)(0,0,1)[12] : 4577.191

ARIMA(0,1,3)(0,0,1)[12] with drift : 4577.708

ARIMA(0,1,3)(0,0,2)[12] : 4574.269

ARIMA(0,1,3)(0,0,2)[12] with drift : 4574.946

ARIMA(0,1,3)(1,0,0)[12] : 4576.379

ARIMA(0,1,3)(1,0,0)[12] with drift : 4576.941

ARIMA(0,1,3)(1,0,1)[12] : Inf

ARIMA(0,1,3)(1,0,1)[12] with drift : Inf

ARIMA(0,1,3)(2,0,0)[12] : 4569.998

ARIMA(0,1,3)(2,0,0)[12] with drift : 4570.839

ARIMA(0,1,4) : 4581.69

ARIMA(0,1,4) with drift : 4582.053

ARIMA(0,1,4)(0,0,1)[12] : 4579.221

ARIMA(0,1,4)(0,0,1)[12] with drift : 4579.733

ARIMA(0,1,4)(1,0,0)[12] : 4578.408

ARIMA(0,1,4)(1,0,0)[12] with drift : 4578.96

ARIMA(0,1,5) : 4583.72

ARIMA(0,1,5) with drift : 4584.063

ARIMA(1,1,0) : 4592.114

ARIMA(1,1,0) with drift : 4592.78

ARIMA(1,1,0)(0,0,1)[12] : 4590.795

ARIMA(1,1,0)(0,0,1)[12] with drift : 4591.591

ARIMA(1,1,0)(0,0,2)[12] : 4589.897

ARIMA(1,1,0)(0,0,2)[12] with drift : 4590.8

ARIMA(1,1,0)(1,0,0)[12] : 4590.336

ARIMA(1,1,0)(1,0,0)[12] with drift : 4591.158

ARIMA(1,1,0)(1,0,1)[12] : Inf

ARIMA(1,1,0)(1,0,1)[12] with drift : Inf

ARIMA(1,1,0)(1,0,2)[12] : Inf

ARIMA(1,1,0)(1,0,2)[12] with drift : Inf

ARIMA(1,1,0)(2,0,0)[12] : 4587.308

ARIMA(1,1,0)(2,0,0)[12] with drift : 4588.314

ARIMA(1,1,0)(2,0,1)[12] : Inf

ARIMA(1,1,0)(2,0,1)[12] with drift : Inf

ARIMA(1,1,0)(2,0,2)[12] : Inf

ARIMA(1,1,0)(2,0,2)[12] with drift : Inf

ARIMA(1,1,1) : 4577.984

ARIMA(1,1,1) with drift : 4578.289

ARIMA(1,1,1)(0,0,1)[12] : 4575.351

ARIMA(1,1,1)(0,0,1)[12] with drift : 4575.838

ARIMA(1,1,1)(0,0,2)[12] : 4572.434

ARIMA(1,1,1)(0,0,2)[12] with drift : 4573.078

ARIMA(1,1,1)(1,0,0)[12] : 4574.518

ARIMA(1,1,1)(1,0,0)[12] with drift : 4575.051

ARIMA(1,1,1)(1,0,1)[12] : Inf

ARIMA(1,1,1)(1,0,1)[12] with drift : Inf

ARIMA(1,1,1)(1,0,2)[12] : Inf

ARIMA(1,1,1)(1,0,2)[12] with drift : Inf

ARIMA(1,1,1)(2,0,0)[12] : 4568.139

ARIMA(1,1,1)(2,0,0)[12] with drift : 4568.95

ARIMA(1,1,1)(2,0,1)[12] : Inf

ARIMA(1,1,1)(2,0,1)[12] with drift : Inf

ARIMA(1,1,2) : 4579.966

ARIMA(1,1,2) with drift : 4580.292

ARIMA(1,1,2)(0,0,1)[12] : 4577.355

ARIMA(1,1,2)(0,0,1)[12] with drift : 4577.857

ARIMA(1,1,2)(0,0,2)[12] : 4574.418

ARIMA(1,1,2)(0,0,2)[12] with drift : 4575.085

ARIMA(1,1,2)(1,0,0)[12] : 4576.524

ARIMA(1,1,2)(1,0,0)[12] with drift : 4577.071

ARIMA(1,1,2)(1,0,1)[12] : Inf

ARIMA(1,1,2)(1,0,1)[12] with drift : Inf

ARIMA(1,1,2)(2,0,0)[12] : 4570.12

ARIMA(1,1,2)(2,0,0)[12] with drift : 4570.951

ARIMA(1,1,3) : 4581.695

ARIMA(1,1,3) with drift : 4582.053

ARIMA(1,1,3)(0,0,1)[12] : 4579.222

ARIMA(1,1,3)(0,0,1)[12] with drift : 4579.743

ARIMA(1,1,3)(1,0,0)[12] : 4578.411

ARIMA(1,1,3)(1,0,0)[12] with drift : 4578.979

ARIMA(1,1,4) : 4573.756

ARIMA(1,1,4) with drift : 4571.09

ARIMA(2,1,0) : 4579.505

ARIMA(2,1,0) with drift : 4579.69

ARIMA(2,1,0)(0,0,1)[12] : 4577.142

ARIMA(2,1,0)(0,0,1)[12] with drift : 4577.505

ARIMA(2,1,0)(0,0,2)[12] : 4575.062

ARIMA(2,1,0)(0,0,2)[12] with drift : 4575.574

ARIMA(2,1,0)(1,0,0)[12] : 4576.421

ARIMA(2,1,0)(1,0,0)[12] with drift : 4576.826

ARIMA(2,1,0)(1,0,1)[12] : Inf

ARIMA(2,1,0)(1,0,1)[12] with drift : Inf

ARIMA(2,1,0)(1,0,2)[12] : Inf

ARIMA(2,1,0)(1,0,2)[12] with drift : Inf

ARIMA(2,1,0)(2,0,0)[12] : 4571.428

ARIMA(2,1,0)(2,0,0)[12] with drift : 4572.095

ARIMA(2,1,0)(2,0,1)[12] : Inf

ARIMA(2,1,0)(2,0,1)[12] with drift : Inf

ARIMA(2,1,1) : 4579.893

ARIMA(2,1,1) with drift : 4580.248

ARIMA(2,1,1)(0,0,1)[12] : 4577.321

ARIMA(2,1,1)(0,0,1)[12] with drift : 4577.839

ARIMA(2,1,1)(0,0,2)[12] : 4574.356

ARIMA(2,1,1)(0,0,2)[12] with drift : 4575.04

ARIMA(2,1,1)(1,0,0)[12] : 4576.493

ARIMA(2,1,1)(1,0,0)[12] with drift : 4577.055

ARIMA(2,1,1)(1,0,1)[12] : Inf

ARIMA(2,1,1)(1,0,1)[12] with drift : Inf

ARIMA(2,1,1)(2,0,0)[12] : 4570.052

ARIMA(2,1,1)(2,0,0)[12] with drift : 4570.9

ARIMA(2,1,2) : 4581.576

ARIMA(2,1,2) with drift : 4582.003

ARIMA(2,1,2)(0,0,1)[12] : Inf

ARIMA(2,1,2)(0,0,1)[12] with drift : Inf

ARIMA(2,1,2)(1,0,0)[12] : Inf

ARIMA(2,1,2)(1,0,0)[12] with drift : Inf

ARIMA(2,1,3) : Inf

ARIMA(2,1,3) with drift : Inf

ARIMA(3,1,0) : 4581.026

ARIMA(3,1,0) with drift : 4581.307

ARIMA(3,1,0)(0,0,1)[12] : 4578.438

ARIMA(3,1,0)(0,0,1)[12] with drift : 4578.91

ARIMA(3,1,0)(0,0,2)[12] : 4575.713

ARIMA(3,1,0)(0,0,2)[12] with drift : 4576.374

ARIMA(3,1,0)(1,0,0)[12] : 4577.627

ARIMA(3,1,0)(1,0,0)[12] with drift : 4578.148

ARIMA(3,1,0)(1,0,1)[12] : Inf

ARIMA(3,1,0)(1,0,1)[12] with drift : Inf

ARIMA(3,1,0)(2,0,0)[12] : 4571.48

ARIMA(3,1,0)(2,0,0)[12] with drift : 4572.324

ARIMA(3,1,1) : 4581.285

ARIMA(3,1,1) with drift : 4581.576

ARIMA(3,1,1)(0,0,1)[12] : 4578.762

ARIMA(3,1,1)(0,0,1)[12] with drift : 4579.224

ARIMA(3,1,1)(1,0,0)[12] : 4577.945

ARIMA(3,1,1)(1,0,0)[12] with drift : 4578.452

ARIMA(3,1,2) : 4568.698

ARIMA(3,1,2) with drift : Inf

ARIMA(4,1,0) : 4575.634

ARIMA(4,1,0) with drift : 4575.534

ARIMA(4,1,0)(0,0,1)[12] : 4574.175

ARIMA(4,1,0)(0,0,1)[12] with drift : 4574.312

ARIMA(4,1,0)(1,0,0)[12] : 4573.622

ARIMA(4,1,0)(1,0,0)[12] with drift : 4573.812

ARIMA(4,1,1) : 4556.801

ARIMA(4,1,1) with drift : 4554.628

ARIMA(5,1,0) : 4561.352

ARIMA(5,1,0) with drift : 4560.508

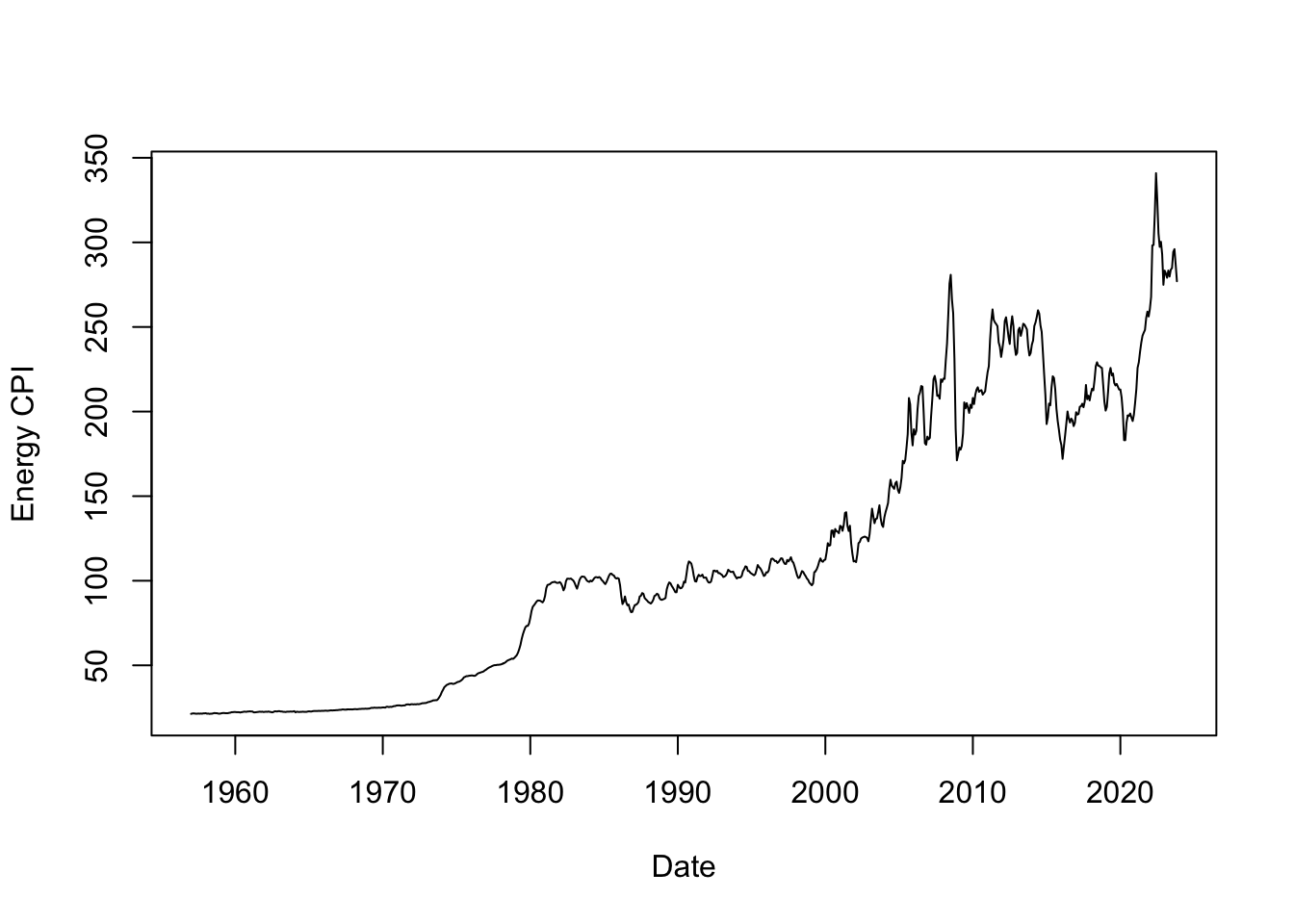

Best model: ARIMA(4,1,1) with drift