library(readr)

library(tibble)

library(ggplot2)

milk <- read_csv('../../../raw_data/milk.csv')

ggplot(milk, aes(x = month, y = milk_prod_per_cow_kg)) +

geom_line()

Francois de Ryckel

September 29, 2022

February 19, 2024

This post is to set up the basic concepts of time-series analysis.

Autocorrelation as the name indicates is the correlation of the time-series with itself, more specifically with a lag version of itself. We can think of it as many different coefficient of correlations. One for each lag. \(r_2\) measure the correlation between the time series at time \(t\) and time \(t - 2\). Similarly, \(r_k\) measure the correlation between the time series at time \(t\) and time \(t - k\)

\[r_k = \frac{\sum_{t=k+1}^T \left( y_t - \bar{y}\right) \left(y_{t-k} - \bar{y} \right)}{\sum_{t=1}^T \left(y_t - \bar{y} \right)^2}\]

More genrally, let’s consider \(\{X_t\}\) a time series.

Now, we define the autocovariance function of the time series as \[\gamma(s, t) = Cov(X_s, X_t) = \textbf{E}[(X_s - \mu_s)(X_t - \mu_t)]\]

In the same vein, we define the autocorrelation function of the time series as \[\rho(s,t) = Corr(X_s, X_t) = \frac {\gamma (s, t)}{\sigma_s \sigma_t} = \frac{Cov(X_s, X_t)}{\sqrt{Var(X_s) Var(X_t)}}\]

Autocovariance and autocorrelation measure the linear correlation between between two points \(X_s\) and \(X_t\) on the same time-series.

Few properties of autocovariance and autocorrelation of time-series

As exercise, we can plot the auto-correlation of a non-stationary (aka with significant autocorrelation) time-series. We are using the Monthly Milk production (no idea where the data come from)

On the autocorrelation plot, the threshold line are situated at \(\pm \frac{2}{\sqrt{T}}\) .

Let’s maybe first have a visual of the data.

library(readr)

library(tibble)

library(ggplot2)

milk <- read_csv('../../../raw_data/milk.csv')

ggplot(milk, aes(x = month, y = milk_prod_per_cow_kg)) +

geom_line()

In R the standard function to plot a correlogram is the acf() function

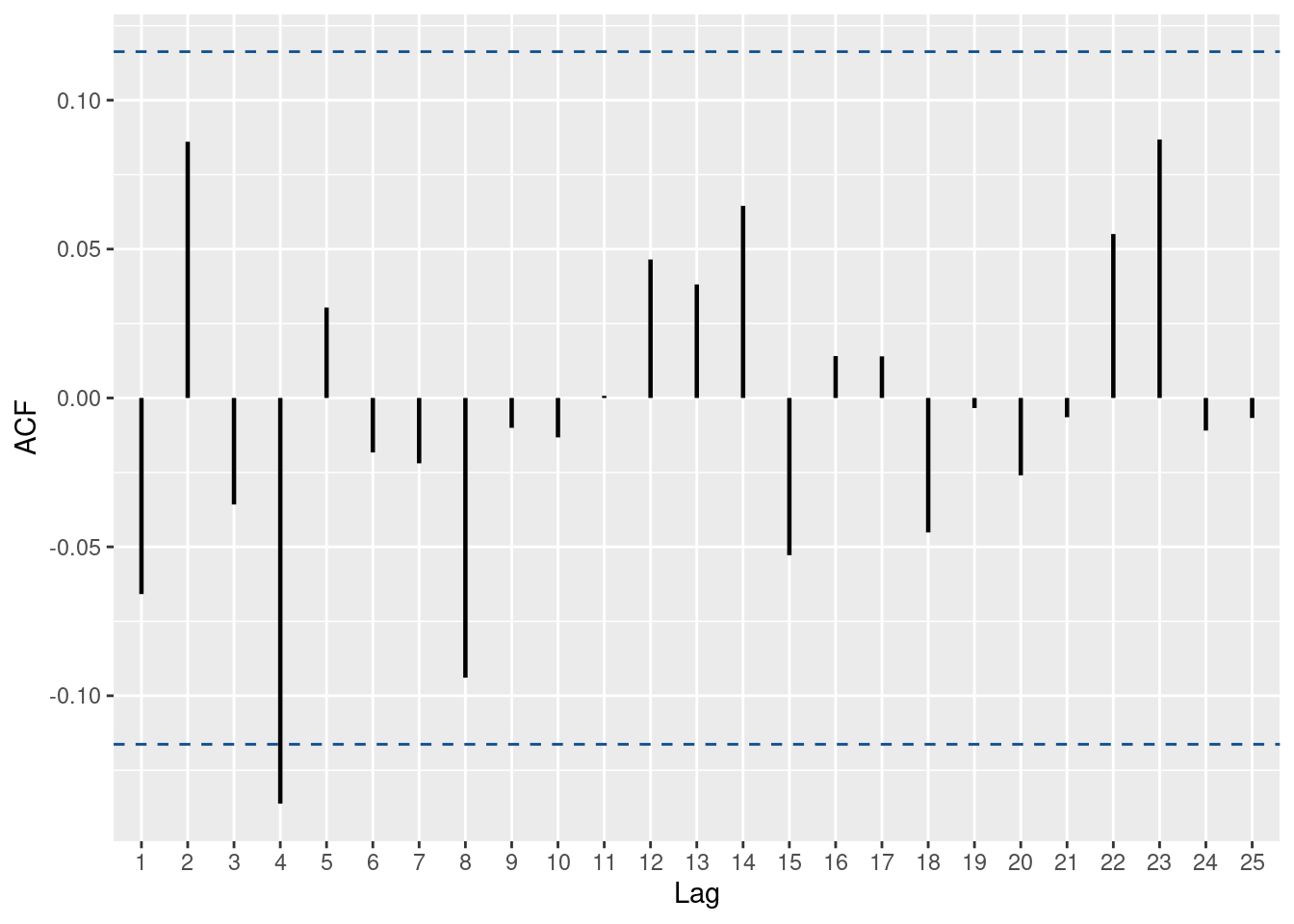

Graph clearly shows some seasonality (at the 12 lags ==> yearly correlation) which indicates that our data are non-stationary (next section). The threshold line is at 0.154 as there are 168 observations in the dataset (number of monthly reported observations)

If we are more attached to the auto-correlation values, we can store the results in a dataframe.

Autocorrelations of series 'milk$milk_prod_per_cow_kg', by lag

0 1 2 3 4 5 6 7 8 9 10 11 12

1.000 0.892 0.778 0.620 0.487 0.428 0.376 0.415 0.454 0.562 0.687 0.769 0.845

13 14 15 16 17 18 19 20 21 22

0.745 0.638 0.490 0.364 0.306 0.255 0.287 0.321 0.417 0.529 We could use the ggplot package to create a function to draw acf and get more customization. We will re-use this function later as well.

# slightly fancier version (with more customization)

ggacf <- function(series, num_lags=25) {

significance_level <- qnorm((1 + 0.95)/2)/sqrt(sum(!is.na(series)))

a <- acf(series, lag.max = num_lags, plot=F)

a.2 <- with(a, data.frame(lag, acf))

g <- ggplot(a.2[-1,], aes(x=lag,y=acf)) +

geom_segment(mapping = aes(xend = lag, yend = 0), linewidth = 0.8) +

xlab('Lag') + ylab('ACF') +

geom_hline(yintercept=c(significance_level,-significance_level), linetype= 'dashed', color = 'dodgerblue4');

# fix scale for integer lags

if (all(a.2$lag%%1 == 0)) {

g<- g + scale_x_discrete(limits = factor(seq(1, max(a.2$lag))));

}

return(g);

}In python, we need to use the statsmodel package.

A time-series \(\{X_t\}\) is (weakly) stationary if:

The Partial Autocorrelation measures the correlation between \(\{X_{t-k} \}\) and \(\{ X_t \}\).

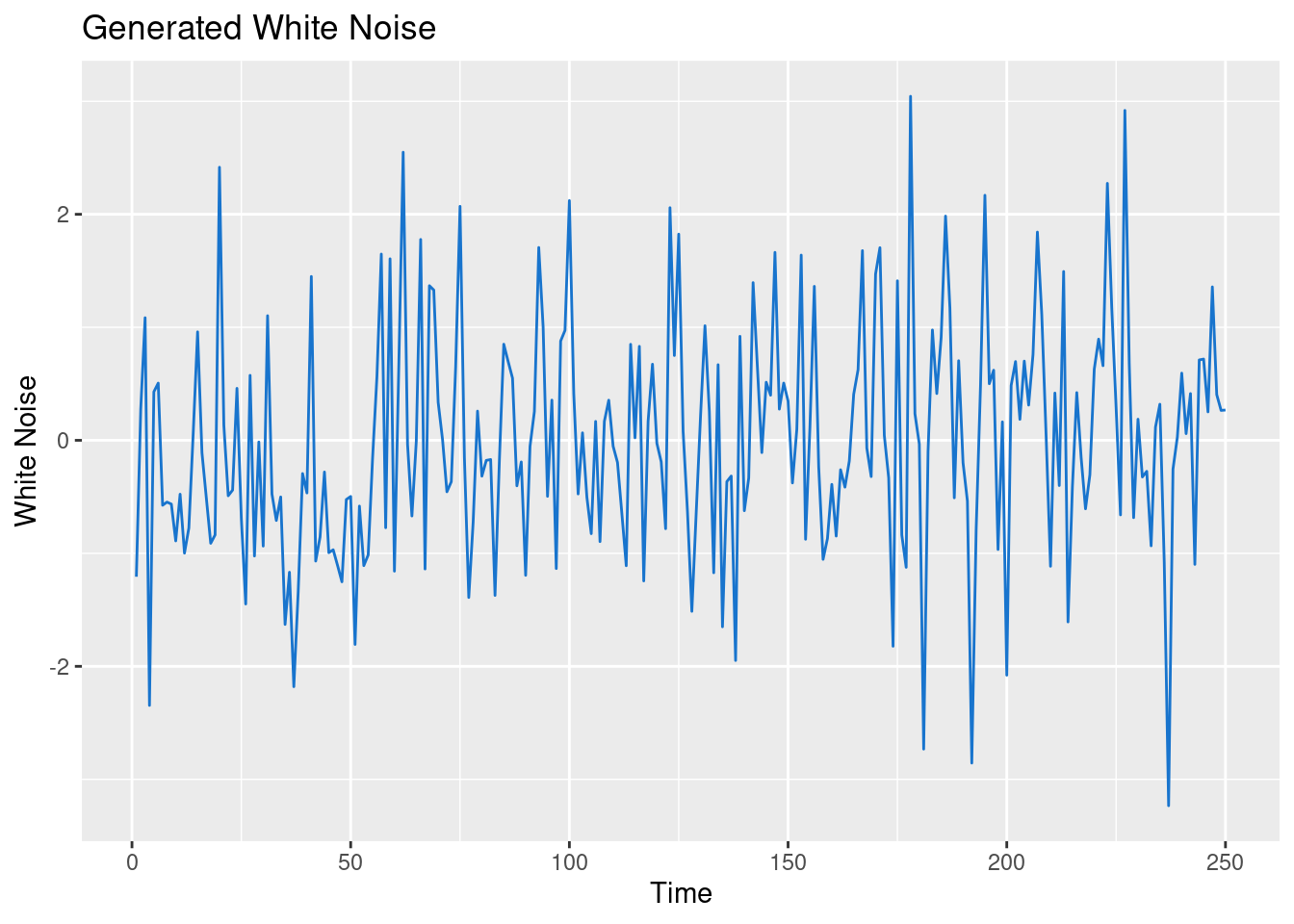

White noise is a special type of time-series and a special case of stationarity. The concept emerge when studying Random Walk.

\(\{X_t\}\) is a random-walk if it satisfies the equation:

\[X_t = X_{t-1} + W_t \tag{1}\] where \(\{W_t\}\) is a white-noise. In other words, \(W_t \sim iid N(0, \sigma_w^2)\)

\(\{W_t\}\) is a white-noise if

If \(\{W_t\}\) is iid (independent and identically distributed) and \(\rho(k) = 1\) (when k=0) and \(\rho(k) = 0\) (otherwise, aka for any other values of k), then \(\{W_t\}\) is a white noise.

Therefore, as \(n \rightarrow \infty\), we can say that \(\frac{1}{n} (X_1 + \dots + X_n) = E[X_t] = \mu\)

A random walk is mean stationary: \(E(X_t) = E(X_0)\). However, the random walk is NOT variance stationary: \(Var(X_t) = Var(X_{t-1}) + \sigma_w^2 \gt Var(X_{t-1})\). Also the random-walk has no deterministic trend nor seasonality.

We can generate white-noise in R using the arima.sim() function.

set.seed(1234)

# Generate a white noise in R

wn <- stats::arima.sim(model = list(order = c(0, 0, 0)), n = 250)

df <- tibble(x = 1:250, y = as.vector(wn))

ggplot(df, aes(x, y)) +

geom_line(color = 'dodgerblue3') +

xlab('Time') + ylab('White Noise') +

labs(title = 'Generated White Noise')

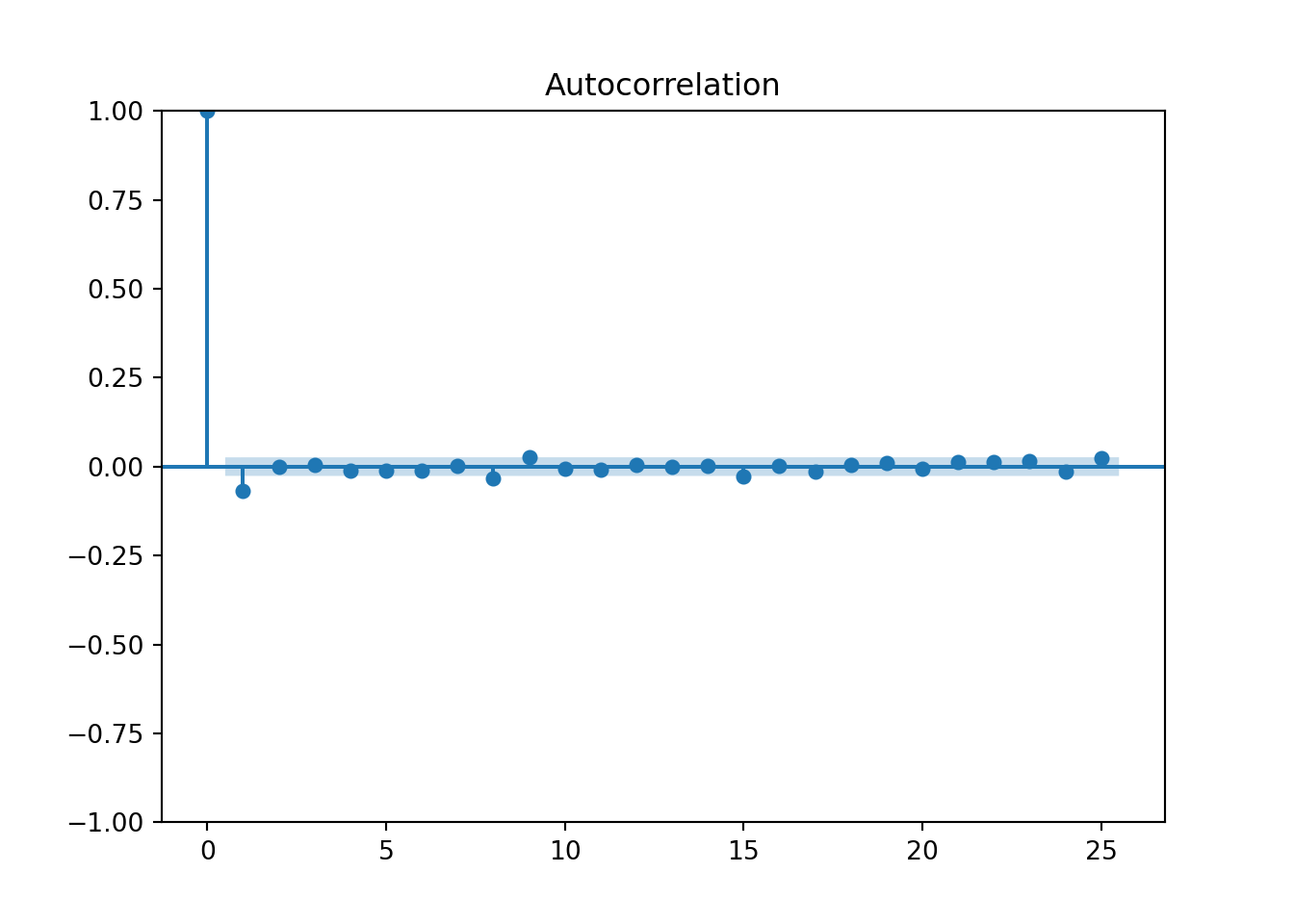

And let’s check the autocorrelation plot to visually confirm that.

We could also use a ggplot function to plot the auto-correlation of our time-series.

In R we can use the Ljung-Box test (Portmanteau ‘Q’ test).

We know that most financial assets prices are not stationary. Let’s take SBUX for instance. That being said, the log difference of their prices is stationary. Note how \(log(P_t) - log(P{t-1}) = log( \frac{P_t}{P_{t-1} )\)

library(dplyr)

library(lubridate)

df <- read_csv('../../../raw_data/SBUX.csv') |> arrange(date) |>

select(date, adjClose) |>

mutate(ret_1d = log(adjClose / lag(adjClose)),

ret_5d = log(adjClose / lag(adjClose, n = 5)),

y_t = log(adjClose) - log(lag(adjClose)),

day_of_week = weekdays(date)) |>

filter(date > '2018-01-01' & day_of_week == 'Tuesday')

ggacf(df$y_t)

from statsmodels.tsa.stattools import acf

from statsmodels.stats.diagnostic import acorr_ljungbox

from statsmodels.graphics.tsaplots import plot_acf, plot_pacf

import pandas as pd

import numpy as np

import matplotlib.pyplot as plt

py_df = pd.read_csv('../../../raw_data/SBUX.csv')

py_df.index = py_df['date']

py_df = py_df.sort_index()

py_df_ts = pd.Series(py_df['adjClose'])

log_ret = np.log(1 + py_df_ts.pct_change())

log_ret = log_ret.dropna()

r, q, p = acf(log_ret, nlags = 25, qstat = True)

fig = plt.figure()

plot_acf(log_ret, lags=25)

plt.show()

array([26.3136516 , 26.316042 , 26.4475469 , 27.2734633 , 28.00235211,

28.69472715, 28.70545674, 35.25084316, 39.48634821, 39.62923899,

40.19059746, 40.26948906, 40.2707996 , 40.27868851, 44.51737182,

44.57802557, 45.63422739, 45.70863764, 46.1791967 , 46.4744188 ,

47.53325326, 48.52664511, 49.81175008, 50.99884363, 54.25246436])array([2.90229916e-07, 1.92994124e-06, 7.68595886e-06, 1.75019647e-05,

3.63602517e-05, 6.94858936e-05, 1.63715557e-04, 2.40667022e-05,

9.41189824e-06, 1.96904817e-05, 3.31867363e-05, 6.48649190e-05,

1.25022094e-04, 2.30799458e-04, 9.12196699e-05, 1.61044765e-04,

1.95803242e-04, 3.27130628e-04, 4.67495545e-04, 6.93532977e-04,

7.95682642e-04, 9.24023511e-04, 9.75159499e-04, 1.05482880e-03,

6.16160760e-04])import pandas as pd

import numpy as np

import matplotlib.pyplot as plt

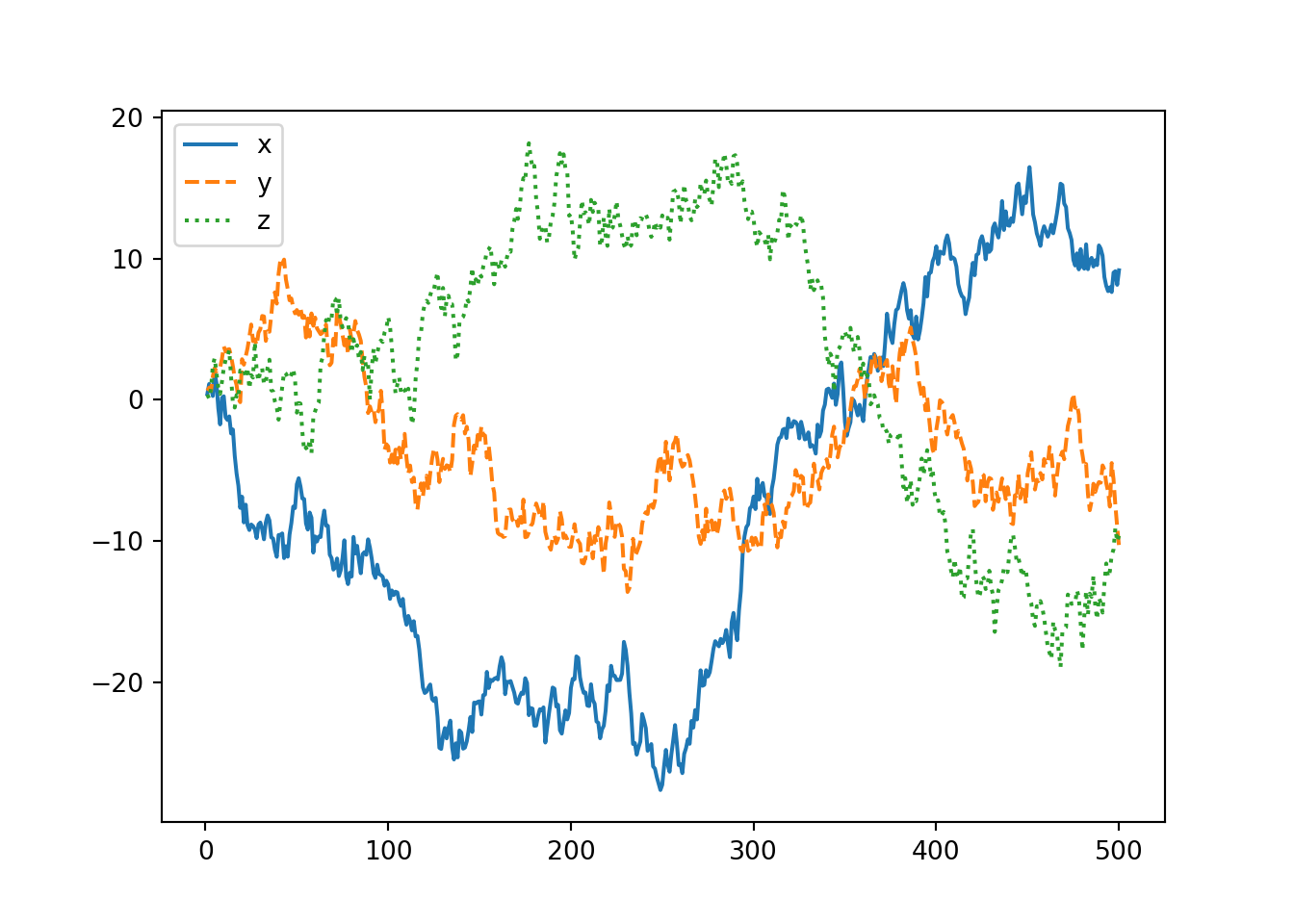

from numpy.random import normal

np.random.seed(190224)

a = normal(size = 500); b = normal(size = 500); c = normal(size = 500)

x = np.cumsum(a); y = np.cumsum(b); z = np.cumsum(c)

df = pd.DataFrame({'x':x, 'y':y, 'z':z})

df.index = range(1, 501)

df.plot(style = ['-', '--', ':'])

plt.show()

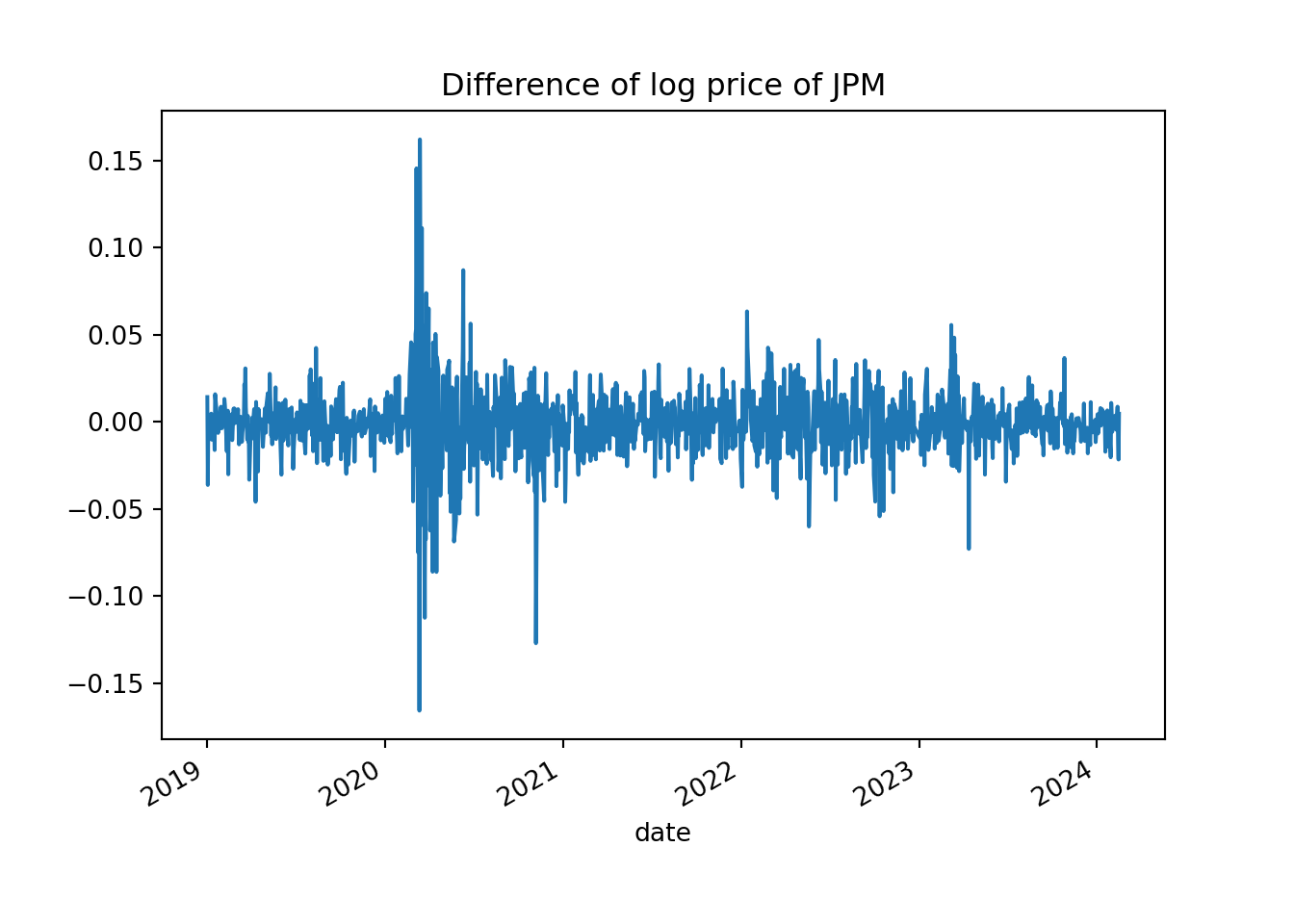

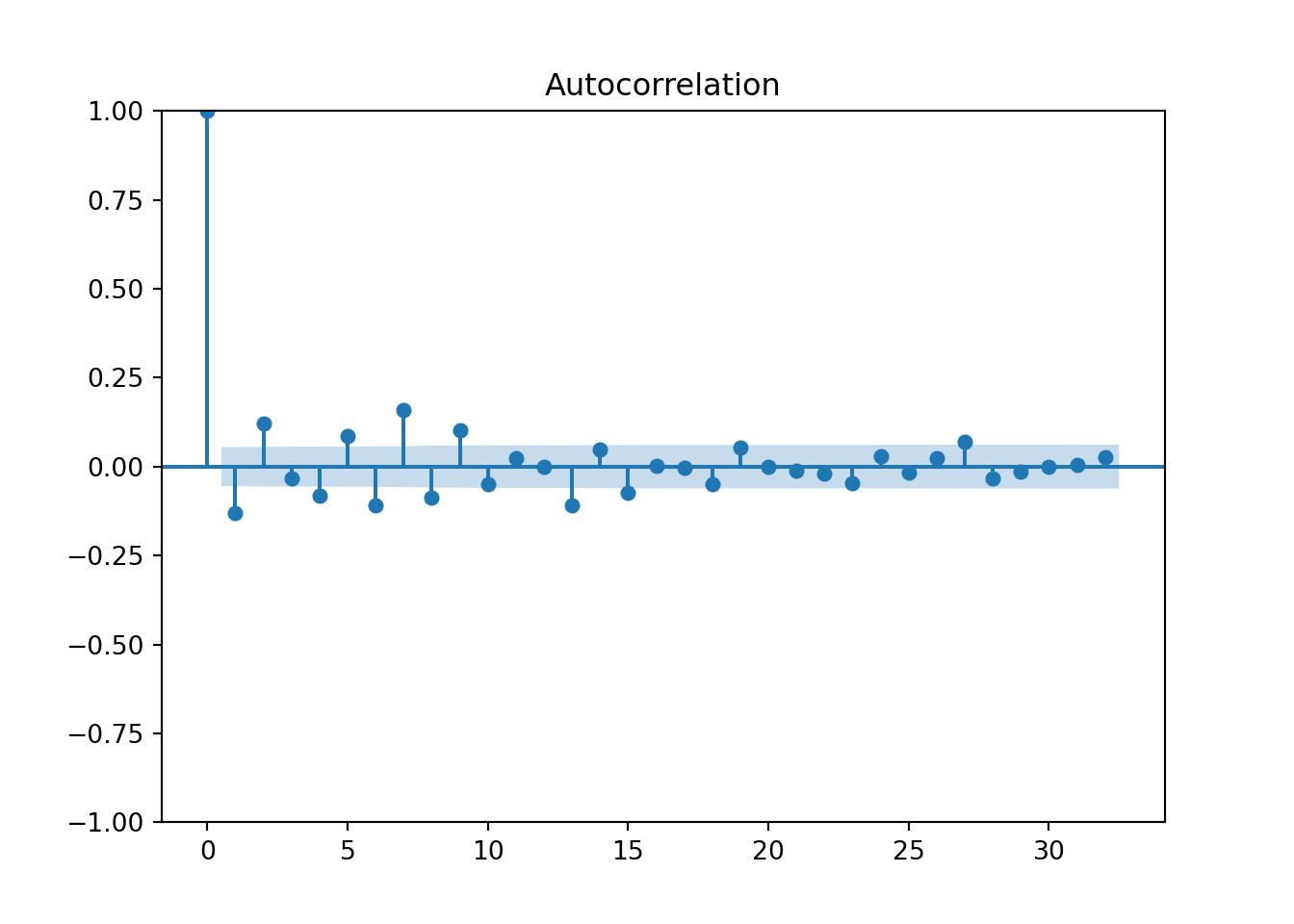

As shown above one way to make a time-series stationary is to take its first difference (or logarithm of its first difference)

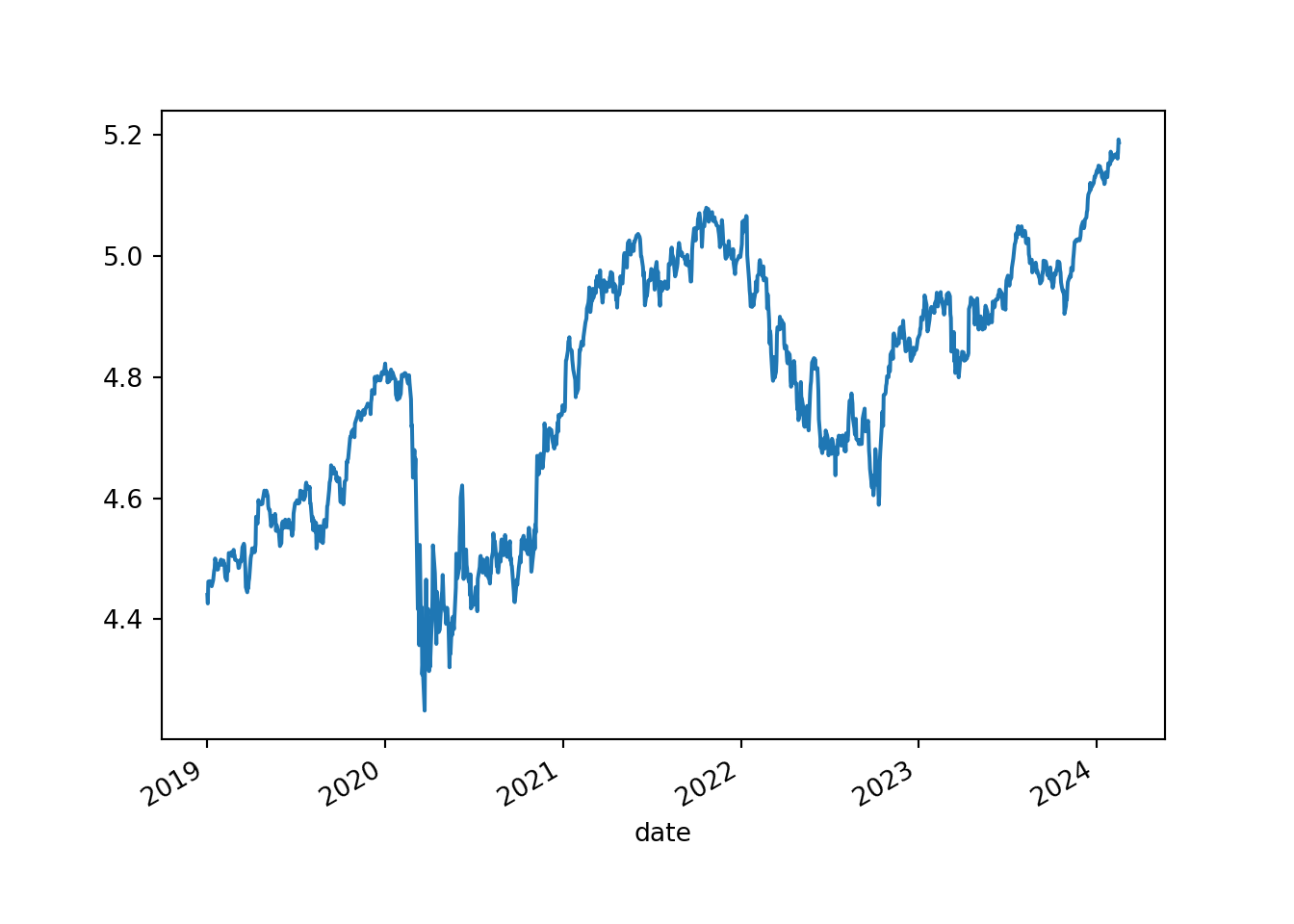

import pandas as pd

import numpy as np

import matplotlib.pyplot as plt

df = pd.read_csv('../../../raw_data/JPM.csv')

df['date'] = pd.to_datetime(df['date'])

df = df[df['date'] > '2019-01-01']

df.index = df['date']

price = df['adjClose']

plt.clf()

price.plot()

plt.title('Price of JPM')

plt.ylabel('Price (in USD)')

plt.show()

# And checking the acf and pcaf

from statsmodels.tsa.stattools import acf, pacf

from statsmodels.graphics.tsaplots import plot_acf

plt.clf()

plot_acf(price)

plt.show()

plt.clf()

diff_log_price = log_price.diff(1)

diff_log_price.plot()

plt.title('Difference of log price of JPM')

plt.show()