import pandas as pd

import numpy as np

def simulate_path(s0, mu, sigma, Time, num_timestep, n_sim):

np.random.seed(20230902)

S0 = s0

r = mu

T = Time

t = num_timestep

n = n_sim

#defining dt

dt = T/t

S = np.zeros((t, n))

S[0] = S0

for i in range(0, t-1):

w = np.random.standard_normal(n)

S[i+1] = S[i] * (1 + r * dt + sigma * np.sqrt(dt) * w)

return SRecall Monte-Carlo method exploits the relationship between options prices and expectation under a risk-neutral measure. It is the present value of the expectation (under a risk-neutral measure) of the payoff. In this sense \[V(S, t) = \text{PV} \space \space \mathbb{E}^\mathbb{Q} (Payoff)\]

We start with the usual SDE (except we use \(r\) instead of \(\mu\) as we are under the risk-neutral framework). \[dS_t = r S_t dt + \sigma S_t dW_t\] Using the Euler discretization \[S_{t + \delta t} = S_t \cdot (1 + r \delta t + \sigma \sqrt{\delta t} \phi)\]

Using Python

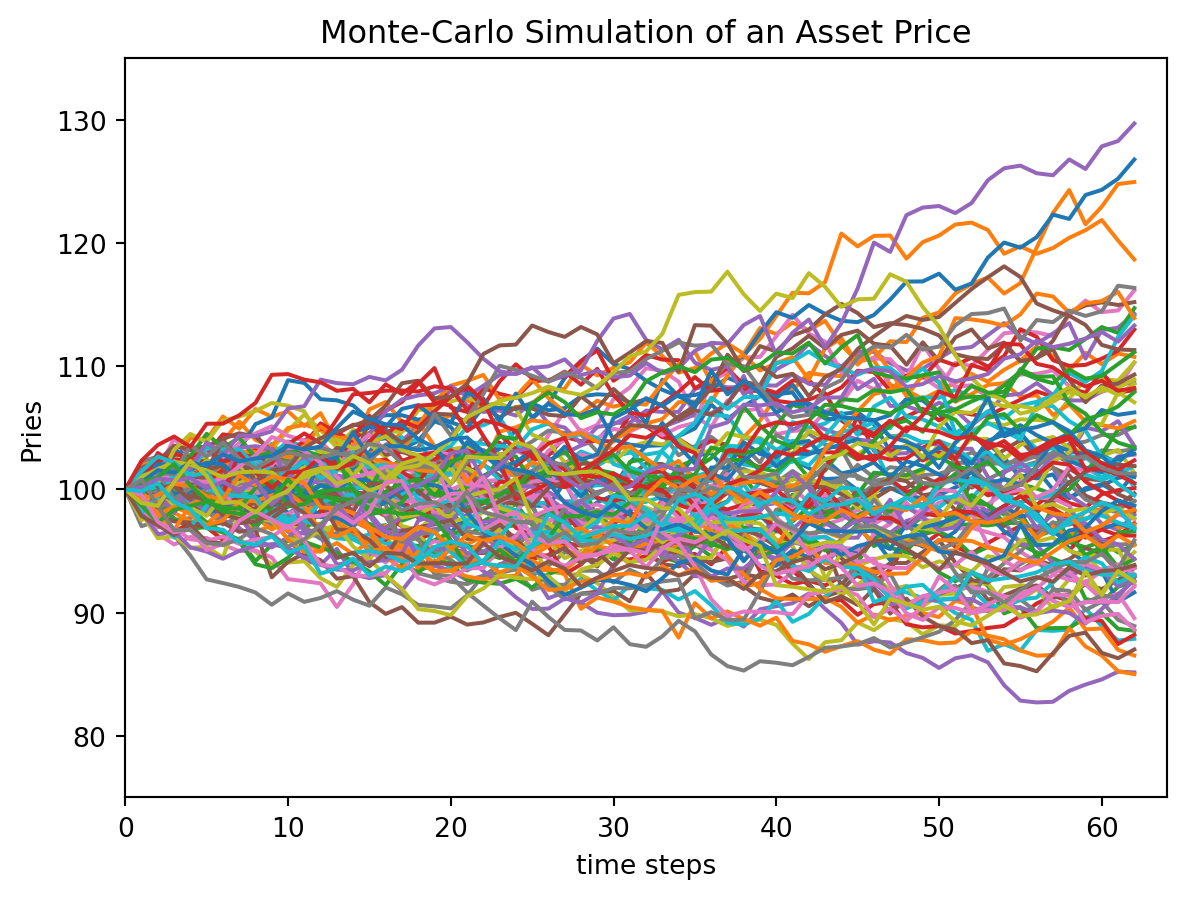

Let’s create a simulation for a quarter of a year (3 months or 63 trading days).

simulate_path(s0=100, mu=0.045, sigma=0.17, Time=0.25, num_timestep=63, n_sim=100)array([[100. , 100. , 100. , ..., 100. ,

100. , 100. ],

[ 99.39825714, 100.88405395, 100.17361119, ..., 100.79029332,

98.89439673, 99.86236711],

[ 99.50936214, 100.97945468, 99.7824842 , ..., 98.66331487,

98.67131431, 100.50278255],

...,

[100.32398459, 110.16941406, 95.79494772, ..., 101.76681189,

91.43131552, 98.94795092],

[100.93630069, 111.0365789 , 94.89177952, ..., 101.32109813,

93.37392012, 98.42725475],

[101.17836924, 110.76099538, 95.51591487, ..., 101.28364139,

92.50938162, 96.80815562]])Let’s put that into a data frame for further plotting and manipulation

Note each column of the data frame is a simulation. The number of rows is the number of time steps.

simulated_paths = pd.DataFrame(simulate_path(s0=100, mu=0.045, sigma=0.17, Time=0.25, num_timestep=63, n_sim=100))simulated_paths.iloc[-1].hist(bins = 100)<Axes: >

import matplotlib.pyplot as plt

plt.plot(simulated_paths) #plot the first 100 paths

plt.xlabel('time steps')

plt.xlim(0, 64)

plt.ylim(75, 135)

plt.ylabel('Pries')

plt.title('Monte-Carlo Simulation of an Asset Price')

plt.show()

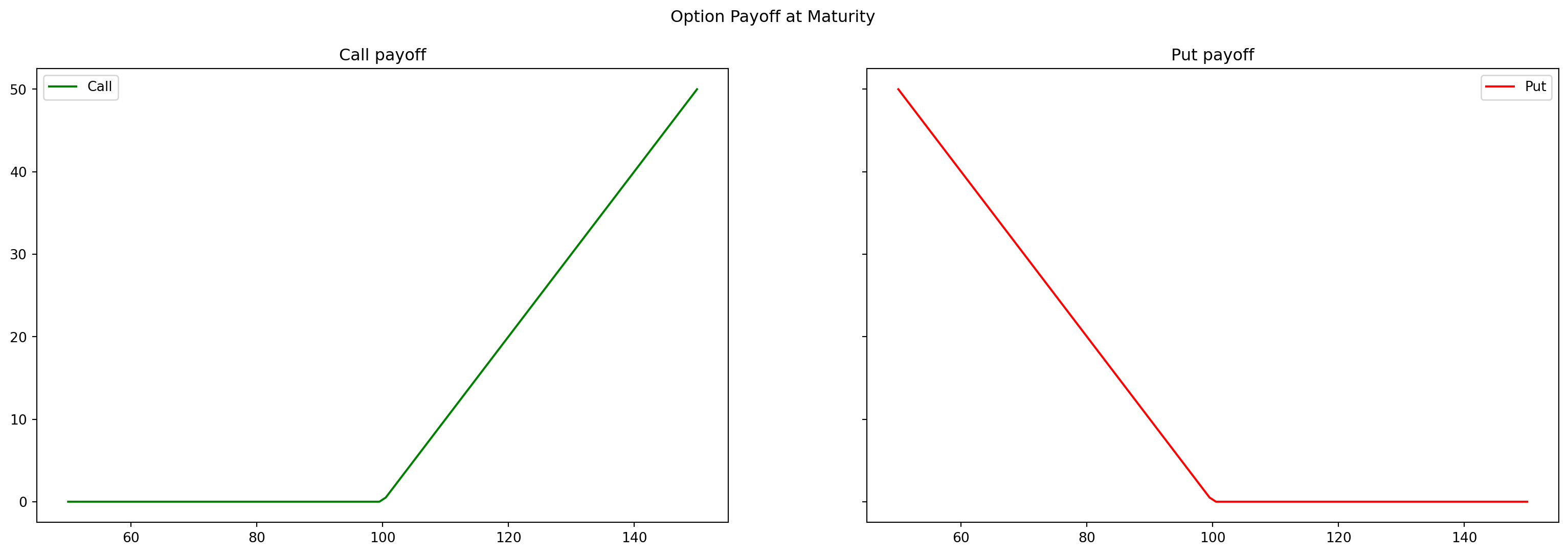

Under the risk-neutral measure, the value of the option is the discounted value of the expected payoff. \[C = e^{rT} \cdot \mathbb{E}[max(S_T - K, 0)]\]

- \(K\) is the strike price

For this simulation, we let \(K=100\) as well!

K = 100

r = 0.045

T = 0.25

S = simulate_path(s0=100, mu=0.045, sigma=0.17, Time=0.25, num_timestep=63, n_sim=10000)

## calculate payoff for call options

Co = np.exp(-r*T) * np.mean(np.maximum(0, S[-1]-K))

## calculate payoff for put options

Po = np.exp(-r*T) * np.mean(np.maximum(0, K - S[-1]))

print(f"European Call Option value is {Co: 0.4f}")

print(f"European Put Option value is {Po: 0.4f}")European Call Option value is 3.8587

European Put Option value is 2.7757import matplotlib.pyplot as plt

sT= np.linspace(50,150,100)

figure, axes = plt.subplots(1, 2, figsize=(20, 6), sharey = True)

title = ['Call payoff', 'Put payoff']

payoff = [np.maximum(0, sT-K), np.maximum(0, K-sT)]

color = ['green', 'red']

label = ['Call', 'Put']

for i in range(2):

axes[i].plot(sT, payoff[i], color = color[i], label = label[i])

axes[i].set_title(title[i])

axes[i].legend()

figure.suptitle('Option Payoff at Maturity')

plt.show()

Asian Options

We are taking the averages of a given asset prices.

A = np.mean(S, axis = 0) # axis = 0, mean is over the columns ==> results is 1000 means. We had a 1000 simulations of 63 steps.

B = np.mean(S, axis = 1) # axis = 1, mean is row by row ==> results is 63 means

K = 100

r = 0.045

T = 0.25

S = simulate_path(s0=100, mu=0.045, sigma=0.17, Time=0.25, num_timestep=63, n_sim=10000)

# do not use S[-1] anymore (the last prices), but the average instead (here it is A)

Co = np.exp(-r * T) * np.mean(np.maximum(0, A - K))

Po = np.exp(-r * T) * np.mean(np.maximum(0, K - A))

print(f"Asian Call Option value is: {Co: 0.4f}")

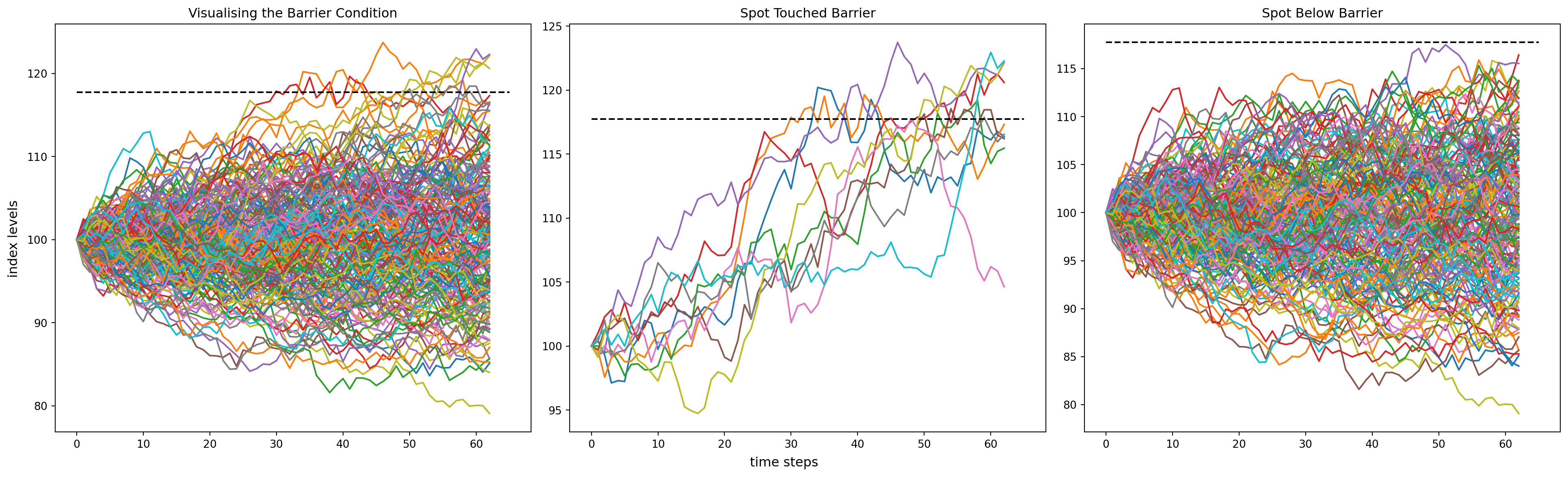

print(f'Asian Put Option Value is: {Po:0.4f}')Barrier options.

Barrier options are path dependent. They’ll need another argument

In a paper titled A Continuity Correction for Discrete Barrier Option, Mark Broadie, Paul Glasser- man and Steven Kou have shown us that the discrete barrier options can be priced using continuous barrier formulas by applying a simple continuity correction to the barrier. The correction shifts the barrier away from the underlying by a factor of \[exp(\beta \sigma \sqrt{\delta_t})\] where \(\beta \approx 0.5826\)

K = 100

r = 0.045

sigma = 0.17

T = 0.25

num_timestep = 63

num_sim = 10000

S = simulate_path(s0=100, mu=0.045, sigma=sigma, Time=T, num_timestep=num_timestep, n_sim=num_sim)

# Let's put the barrier at 117 ! we call it B

B = 117

delta_t = T / num_timestep

rebate = 10

value = 0

beta = 0.5826

# Barrier shift - continuity correction for discrete monitoring

B_shift = B * np.exp(beta * sigma * np.sqrt(delta_t))

print(B_shift)

# finding discounted value of expected payoff

for i in range(num_sim):

# if final price of one simulation is less that the Barrier shift

if S[:,i].max() < B_shift:

value += np.maximum(0, S[-1, i] - K)

else:

value += rebate

Co = np.exp(-r * T) * (value/num_sim)

print(f'The up-and-out Barrier Option value is {Co:04f}')117.73225187428132

The up-and-out Barrier Option value is 3.369172figure, axes = plt.subplots(1,3, figsize=(20,6), constrained_layout=True)

title = ['Visualising the Barrier Condition', 'Spot Touched Barrier', 'Spot Below Barrier']

axes[0].plot(S[:,:200])

for i in range(200):

axes[1].plot(S[:,i]) if S[:,i].max() > B_shift else axes[2].plot(S[:,i])

for i in range(3):

axes[i].set_title(title[i])

axes[i].hlines(B_shift, 0, 65, colors='k', linestyles='dashed')

figure.supxlabel('time steps')

figure.supylabel('index levels')

plt.show()

import numpy as np

import pandas as pd

import matplotlib.pyplot as plt

def create_price_path(S0, rfr, sigma, time_horizon, num_steps, num_sim):

np.random.seed(18092023)

dt = time_horizon / num_steps

S = np.zeros((num_steps, num_sim))

S[0] = S0

for i in range(0,num_steps-1):

phi = np.random.standard_normal(num_sim)

S[i+1] = S[i] * (1 + rfr * dt + phi * sigma * np.sqrt(dt))

return S

S = create_price_path(100, 0.045, 0.17, 1, 252, 10000)

# for a european option.

K = 100

r = 0.05

T = 0.55

C0 = np.exp(-r*T) * np.mean(np.maximum(0, S[-1]-K))

C09.038910855148245